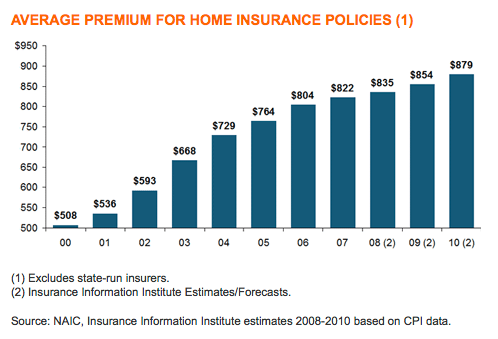

Home Insurance Premiums that Continue to Increase

Last year the UK average premium for Building Insurance increased 1% to more than £ 205 and the average for Fill Insurance rose to £ 151, up 2%. But on the market we have seen a much bigger increase - if you are with Norwich Union you will see your premium increase around 6%.

|

| Home Insurance Premiums that Continue to Increase |

So what happened? Every year we see premiums increasing. Of course, with so much competition in the home insurance market, you wouldn't expect to see such an unavoidable increase in premiums?

Let's consider the situation more carefully.

The cost of repairing and rebuilding houses is a reflection of rising labor prices and building materials. This means that costs for insurance from claims under the building cover also increase. So when their costs go up, so does your premium. And there is also an undeniable fact that cost inflation also affects the operational costs of insurance companies themselves. If possible, they will add a little extra to it!

Then there is beautiful English weather. Michael Fish can be forgiven for believing that we don't live in a hurricane zone, but however the fact that storms, and especially floods, is more common. Flood damage can be very damaging, according to the British Insurance Association, insurance claims averaged between £ 15,000 and £ 30,000. And for the past 18 months we've seen devastating floods making headlines at Helmsley in North Yorkshire, Carlisle, and Boscastle in Cornwall. These events must have cost millions of insurance companies.

Another area where costs have increased is burglary. The average theft claim has now risen to around £ 1,400. There seem to be two reasons - the first thief found that the results were easier to obtain and continued. Modern family homes are filled with valuable electronic gismos - from laptops to pods, digital cameras and flat-screen TVs. Another reason is that more thieves target rich neighborhoods.

Against this background the insurance company can determine the price of the house and the contents of the insurance until the individual zip code. If their records indicate problems with flooding, or subsidence, or increased theft incidents in your area, their computers will load your premiums to reflect additional risks.

Discounts without your claim will only function to offset this upward pressure to a certain extent. And don't forget that once you have a five-year record without claims, your discount doesn't increase, it's limited. After that, all premium increases will land completely in your lap.

So what can you do to save money?

The most important step so far, is to go around every year for the best available deals. This might be a task, but thirty or forty minutes on the Internet (including ten minutes on this website!) Will give you results. Within that period you will find the cheapest insurance company and, as an online customer, you may be eligible for an additional 10% discount. Then you can always agree to pay by direct debit - it will also cut a little more.

Also Read : Popular Graphic Design Magazine

Of course there are other things you can do, especially in the home security arena. Join a local environmental monitoring scheme, install a security key in your windows, fit external security lighting, increase the lock on your door and get a burglar alarm. Additional security will give you a discount on your insurance, but it will cost you money to install! Maybe just adding peace of mind will be worth the cost. Only the local environmental monitoring scheme is received free! The best general rule is not to last too long with the same insurance company. Keep them on their feet. They have a tendency to just accept loyal customers. Yes, it really pays to go around - try and prove it yourself!